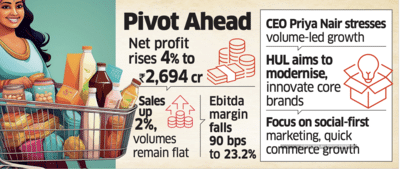

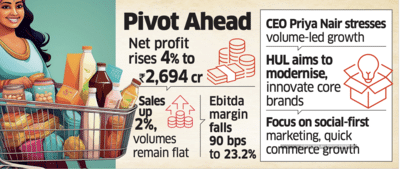

Mumbai: Hindustan Unilever, India's biggest consumer goods company, Thursday said it expects a stronger second half in FY26 as benign commodity prices, easing food inflation, and stable consumer demand combine to boost volumes, aiding topline recovery after several quarters of circumspect performance. Net profit climbed 4% in the September quarter.

The maker of Dove and Sunsilk soaps and shampoo posted a 2% increase in sales during this quarter, although volume growth that measures the number of products people put in their shopping carts remained flat.

The company’s profit before tax as well as exceptional items fell 4%,though net profit increased to ₹2,694 crore.

‘Right Fiscal Leverage’

The rise in net profit is driven by a one-off positive impact after the resolution of the company’s prior years’ tax matters between the British and Indian tax authorities.

Also Read: After GST reforms, firming rural & urban demand to lift Hindustan Unilever volumes

CEO Priya Nair, the first woman to helm the FMCG major, attributed the company’s circumspect performance to ‘unfavourable’ macroeconomics, while underscoring the need to drive volumes-led growth.

“Our focus or obsession is going to be on volume-led revenue growth. If I had to tell you how we will look at the business, it will be unblinkingly looking at growth,” Nair said during a post-earnings call with analysts. “When we do that, we have the right financial leverage to deliver the operating margin for the business. So, for me, that is simply how we would run this business.”

Also Read: HUL Q2 Results- Cons PAT rises 4% YoY to Rs 2,685 crore; revenue up 2%

As GST cuts take effect and the reductions help normalise the supply chain, the company expects the second half of FY26 to provide the much-needed volumes-driven growth. “We expect the second half of the financial year to be better than the first, driven by volume-led acceleration,” said Ritsh Tiwari, chief financial officer, Hindustan Unilever.

DEMAND GAUGE

Its performance is considered a proxy for broader consumer sentiment in India. The company's value sales growth has been swinging between near-flat and 4% for nearly two years.

It reported sales of Rs 16,061 crore for the second quarter. Its earnings before interest, taxes, depreciation and amortisation (Ebitda) margin fell 90 basis points year-on-year to 23.2% in the quarter.

One basis point is a hundredth of a percentage point.

“The macroeconomic conditions in India were not favourable,” Nair said. “FMCG demand has been subdued — whether on account of high food inflation, income pressures, wage inflation, or weather vagaries.”

Nair, in her first media briefing since taking charge in August, said HUL needs to modernise its core brands through innovation to make them more relevant and also double down on investments in social-first marketing and quick-commerce platforms, which are gaining traction among urban shoppers.

“India is transforming. Affluence is rising with GDP growth, but what’s fascinating is that there are 400 million Gen Z consumers," said Nair. She said she has spent her first few weeks back on the front line, visiting stores, meeting consumers, and engaging with trade partners to assess how the market is shifting.

"They are changing how households consume. More women are working, almost 40% participation, with the biggest jump in rural India and the digital revolution is transforming awareness, access, and buying behaviour across both rural and urban India," she added.

GST REFORMS

The performance comes against the backdrop of India’s Goods and Services Tax (GST) transition, which disrupted trade inventory and sales for the entire consumer industry including the FMCG major.

That company said it had communicated closely with trade partners and offset some of the challenges, but the transitional effects still weighed on near-term volumes and impacted sales by roughly 2%.

The maker of Dove and Sunsilk soaps and shampoo posted a 2% increase in sales during this quarter, although volume growth that measures the number of products people put in their shopping carts remained flat.

The company’s profit before tax as well as exceptional items fell 4%,though net profit increased to ₹2,694 crore.

‘Right Fiscal Leverage’

The rise in net profit is driven by a one-off positive impact after the resolution of the company’s prior years’ tax matters between the British and Indian tax authorities.

Also Read: After GST reforms, firming rural & urban demand to lift Hindustan Unilever volumes

CEO Priya Nair, the first woman to helm the FMCG major, attributed the company’s circumspect performance to ‘unfavourable’ macroeconomics, while underscoring the need to drive volumes-led growth.

“Our focus or obsession is going to be on volume-led revenue growth. If I had to tell you how we will look at the business, it will be unblinkingly looking at growth,” Nair said during a post-earnings call with analysts. “When we do that, we have the right financial leverage to deliver the operating margin for the business. So, for me, that is simply how we would run this business.”

Also Read: HUL Q2 Results- Cons PAT rises 4% YoY to Rs 2,685 crore; revenue up 2%

As GST cuts take effect and the reductions help normalise the supply chain, the company expects the second half of FY26 to provide the much-needed volumes-driven growth. “We expect the second half of the financial year to be better than the first, driven by volume-led acceleration,” said Ritsh Tiwari, chief financial officer, Hindustan Unilever.

DEMAND GAUGE

Its performance is considered a proxy for broader consumer sentiment in India. The company's value sales growth has been swinging between near-flat and 4% for nearly two years.

It reported sales of Rs 16,061 crore for the second quarter. Its earnings before interest, taxes, depreciation and amortisation (Ebitda) margin fell 90 basis points year-on-year to 23.2% in the quarter.

One basis point is a hundredth of a percentage point.

“The macroeconomic conditions in India were not favourable,” Nair said. “FMCG demand has been subdued — whether on account of high food inflation, income pressures, wage inflation, or weather vagaries.”

Nair, in her first media briefing since taking charge in August, said HUL needs to modernise its core brands through innovation to make them more relevant and also double down on investments in social-first marketing and quick-commerce platforms, which are gaining traction among urban shoppers.

“India is transforming. Affluence is rising with GDP growth, but what’s fascinating is that there are 400 million Gen Z consumers," said Nair. She said she has spent her first few weeks back on the front line, visiting stores, meeting consumers, and engaging with trade partners to assess how the market is shifting.

"They are changing how households consume. More women are working, almost 40% participation, with the biggest jump in rural India and the digital revolution is transforming awareness, access, and buying behaviour across both rural and urban India," she added.

GST REFORMS

The performance comes against the backdrop of India’s Goods and Services Tax (GST) transition, which disrupted trade inventory and sales for the entire consumer industry including the FMCG major.

That company said it had communicated closely with trade partners and offset some of the challenges, but the transitional effects still weighed on near-term volumes and impacted sales by roughly 2%.

You may also like

Varun Badola on Jamnapaar S2: 'We've addressed issues that every Indian family goes through

K'taka HC to hear petitions of RSS, five others seeking nod for padayatra on Nov 2 in Chittapur

Andhra accident: Death toll in bus fire tragedy goes up to 19

World Bank Programme to provide better health coverage to 11 million people in Kerala

Rajasthan: Woman drowns her three children in water tank in Balotra, later dies by suicide